OUT OF THE BOX by José Carlos Jarillo

By starting to discount just a mild recession, or even a “soft landing”, markets have been more optimistic in the last months. In other words, a slowdown in economic activity that is important enough to lower inflation to acceptable levels but is short of being a serious recession. The next few months will tell us whether this optimism is warranted. However, an issue that we have already discussed (and will continue discussing, since it will not go away) could have a very negative impact on economic activity and is currently not being discounted: the lack of abundant, reasonably priced energy.

Logically seen, mankind consumes as much energy as it produces. Inventories, however, make a difference. If we have ample stocks, we can consume more than we produce … for a while. Conversely, if we produce more than we consume, we need to put the excess amount into some sort of inventory, whose capacity will necessarily be limited.

For physical reasons, stocks cannot be very large compared to consumption. The world oil stocks, for instance, fluctuate around the equivalent of 4 weeks of consumption. Natural gas is stocked during the summer and is basically consumed during the winter. Uranium, which is exceptionally energy-dense, can be stockpiled for a few years, but very few other commodities have stocks that are equivalent to more than a few weeks of normal consumption.

In reality, there are two kinds of stocks: those that are included in the previous paragraph (physical accumulations of the commodity in some sort of “warehouse”), and the amounts of the commodity lying underground in mines or fields that are already producing or are ready to produce. We don’t count them as “stocks” (instead as “reserves”), but these are commodities ready to be produced if/when there is a need.

It’s obvious that demand cannot exceed supply beyond the “cushion” provided by stocks. In other words, if stocks are not replenished, it is only a matter of time until consumption is cut, or production is sharply increased. In the real world, stocks cannot be reduced to zero, because any commodity’s supply chain requires a lot of inventory for itself: In the case of oil, this is the content of pipelines, oil in transit on ships, minimum inventories in refineries, etc. This need for a minimum stock is especially pressing in terms of key commodities, since no country can afford to be deprived of energy for even a short amount of time (which would have economic and geostrategic consequences).

The world has spent the last few years running down its inventories of crucial commodities. First, the inventories “above ground”, i.e., the visible ones:

World oil inventories (source, Energy Information Agency)

However, inventories “in the ground” are far more important, because they are much larger than inventories “above the ground”. As we said, ready inventories amount to a few weeks of consumption, whereas producing reserves can go on for a few years. And these “in the ground” inventories are also declining fast.

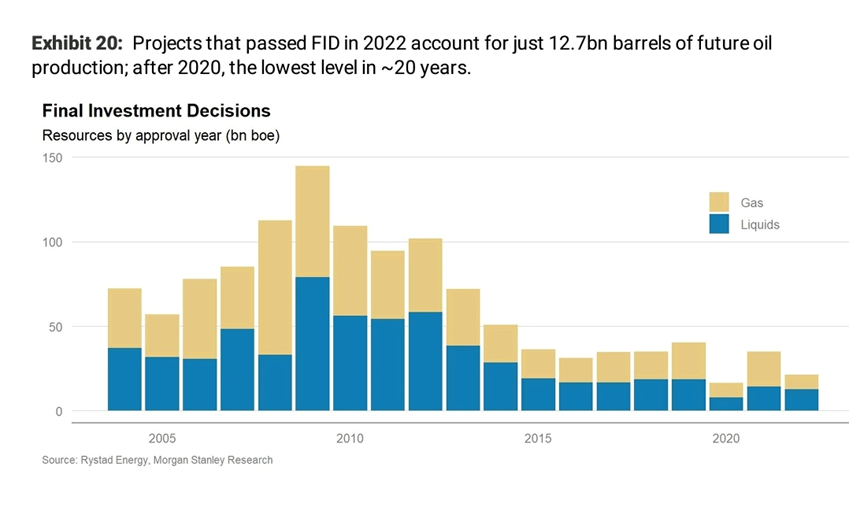

Figure 20 shows the amount of new oil and gas that developments approved for investment each year can produce. For the last few years, the world has been approving a production capacity equivalent to about one third of what we are consuming for development. Although, “above ground” inventories are not yet zero, the total amount of oil and gas available for consumption is decreasing relentlessly.

As soon as the above ground inventory hits uncomfortably low levels (which is about to happen in the next few quarters), the world will realize that there are no oil or gas fields capable of refilling them while maintaining the usual level of demand. An important price spike can be expected.

Will this derail inflation’s current positive trend? Possibly. But, whatever the case, it will make maintaining an orderly economic activity without enough energy extremely difficult.

In fact, it’s interesting to note that when “normal” energy is not available, societies turn to whatever is at hand to keep functioning. The following chart shows that amount of CO2 generated in Europe and the details regarding Germany. This country, with its Green Party in government, and whose conservatives proclaimed its “Energiewende”, is burning record amounts of low-quality coal (abundant in Germany) to keep everything going, even though it is only facing a smidgeon of natural gas scarcity.

We will see this kind of behavior increasingly within the next few years.

Related posts:

- FINANCIAL CENTRE SWITZERLAND & FUND BOUTIQUES: SWISS VALUE DAY – Intrinsic Values, Case Studies, Strategic Value Investing & Fireside Chat (10/6/2022, Zurich, Strategic Investment Advisors – SIA & BWM Value Investing) – Fund Boutiques

- FUND BOUTIQUES & Private Label FUNDS: Value Investing, Commodities, and Inflation – Sharing Alpha & Ray Dalio (Interview – Alex Rauchenstein, SIA Funds AG) – Fund Boutiques

- FONDSBOUTIQUEN & PRIVATE LABEL FONDS: Value Investing & Commodities – SIA Video Call (Veranstaltungshinweis, 11.2.2022, SIA Funds AG) – Fund Boutiques

- FUND BOUTIQUES & PRIVATE LABEL FUNDS: Swiss Financial Center and Commodities – “THE WORLD FOR SALE – Money, Power and the Traders Who Barter the Earth’s Resources” (Book Review – Urs Marti, SIA Funds AG) – Fund Boutiques

- FUND BOUTIQUES & PRIVATE LABEL FUNDS: Financial Center Switzerland & Frankfurt, Asset Management, Value Investing, Commodities & Networking – Zurich, Commodity Day, MainNizza and Economic History (Interview & Event Information – Alex Rauchenstein, SIA Funds AG) – Fund Boutiques

- FUND BOUTIQUES & PRIVATE LABEL FUNDS: Value Investing, Commodities, ESG – China, Oil, Nuclear Energy & General Patton (Interview – Urs Marti, SIA Funds AG) – Fund Boutiques