“Las Vegas is busy every day, so we know that not everyone is rational.” -Charles Ellis

One question that has haunted us since stock exchanges have existed is how decisions are made in the capital market. Rationalism gave rise to some of our central variables and represented the central current of philosophy. In simplified terms, human beings are supposed to use their minds to make decisions and thus make only rational decisions. The aspect of “perfect rationality” as well as the doctrine of homo oeconomicus was already taken up by Adam Smith in 1776 and is still widely recognized in the literature today (Standard Finance), even if the practitioner’s hair may stand on end at the thought of a person thinking explicitly rationally.

Where the doctrine of homo oeconomicus and the “fairy tale” of perfect rationality is exhausted, behavioral finance and neuronal finance come into play.

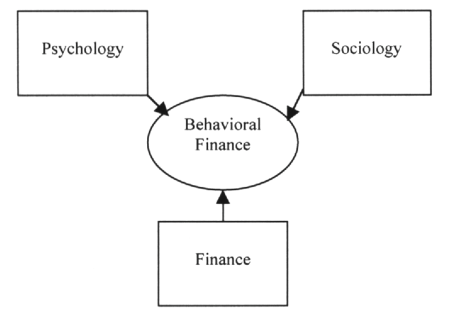

Behavioral finance traces decision-making back to psychological, cognitive, cultural, and social factors (see Figure 1) and thus proves to be much more practical. These influences on our decision-making are evolutionary, have stood the test of time over millennia, and have contributed to human survival, among other things.

Quelle: Victor Ricciardi, Helen K. Simon (2000). „What is Behavioral Finance“ Business, Education and Technology Journal Fall

Although these influences on the financial market player cannot be eliminated, nonetheless proves advantageous to be familiar with the influences on decision-making. It is because our decision-making is quite fundamentally influenced by the perception and evaluation of opportunities & risks as well as by the handling of losses, but also gains.

People tend to assess themselves and their abilities along with their prospects for gains higher than they are. It leads to a distorted and partly wrong perception of risks. Men in particular are subject to the phenomenon of “overconfidence.” Numerous studies show that men are more willing to take risks and, statistically speaking, trade significantly more often.

“Overconfidence is a very serious problem. If you don’t think it affects you, that’s probably because you’re overconfident.” – Carl Richards

Hand in hand with overconfidence goes the phenomenon of confirmation bias. Confirmation bias is the tendency to ignore or give less weight to information that does not fit the trader’s opinion or decision. For example: If we buy a stock, we look for and select mainly such information that supports the decision to buy the stock. This is because people always look for consistency in their behavior – if inconsistency or dissonance appears, we try to reduce it. The solution when dissonance arises is therefore a selective and distorted perception and weighting of information (“subtraction”).

This can even go so far as to abandon entire trading and investment strategies to which the investor had originally subscribed to justify the investment decision made in retrospect (financial cognitive dissonance).

Losses outweigh profits

“Trade out of a fucking position” is one of the basic rules of thumb that every trader knows. And yet, with poorly performing positions, the question regularly arises again: sell or hold? But why do we find this decision so incredibly difficult every time?

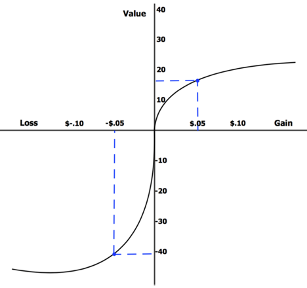

More than 35 years ago, Kahnemann (Nobel Prize winner 2002) and Tsversky found out in the context of their Prospect Theory that the evaluation of losses and gains under uncertainty is not rational or linear and thus deviates significantly from mathematical models. This is because: losses weigh more heavily than gains and have diminishing marginal returns to a valuation with increasing magnitude (see Figure 2).

Source: Wikimedia Commons

One would think that the valuation of the “win 50€” scenarios should be the same as the valuation of the “win 100€, lose 50€” scenario, since the result, i.e. a profit of 50€, has the same value. However, losses weigh two to three times as heavily as gains, which is why scenario 2 feels statistically worse.

So we tend to measure our losses not rationally in monetary units, but in regret (“Regret)”. The larger the (book) loss the larger the Regret. The larger the Regret, the more difficult the decision to sell will be. The conflict between selling or holding creates an inner conflict that we as individuals would like to avoid if possible. The solution: holding very bad positions to avoid regret, so that the result in the portfolio is to hold particularly poorly performing positions.

In addition, selling a poorly performing position means realizing losses and, at the same time, admitting to a poor investment decision combined with a possible loss of reputation within the social environment (herding).

These high emotional thresholds when selling bad positions lead to an asymmetry within portfolios (disposition effect). Contrary to theory, winners are sold too early while losers are held too long.

What does this mean for the financial world?

After this excursion into psychology and sociology, we, therefore, conclude that human decisions are highly dependent on many uncontrollable parameters and are certainly not rational – decision-making is consequently prone to error, regardless of whether fund manager or private investor. The current state of knowledge shows that the error devils of behavioral finance can be reduced or avoided if fixed trading processes are established or algorithms, AI or other technical tools accompany the decision-making process.

“The investor’s chief problem – and even his worst enemy – is likely to be himself.” – Benjamin Graham

There are already some fund boutiques that have discovered novel approaches for themselves. Especially fund boutiques with their comparatively high agility and affinity for future trends give institutional as well as private investors access to financial products that are suitable to minimize the influences of behavioral finance.

Especially in terms of private investors, various studies show that this group is particularly subject to the influences of behavioral finance and other heuristics – especially problematic in an increasingly democratized financial world, which more and more private investors are discovering for themselves in the wake of the Corona crisis. The solution there is only one: Financial education, starting in early adolescence. That’s why financial education is also close to our hearts, so we try to make our contribution within our network.

The two authors, Mats, and Matti Wolk, are about to complete their studies in business administration and commercial law, respectively, and have a keen interest in all topics relating to financial markets and financial education.

Since the beginning of the year, they have been supporting their father Norbert Wolk, who launched the Barbarossa European Endowment Fund, a UCITS tailored to the needs of endowments, in the areas of portfolio management, marketing and sales.

The trading strategy and the investment process of the Barbarossa European Endowment Fund provide investors with an investment opportunity largely adjusted for the influences of behavioral finance.

Related Posts: