Institutional investors are increasingly looking for attractive opportunities in the field of real estate investments outside Germany. Investment boutiques have been attracting great interest from family offices and traditional institutional investors for years in the area of real assets. Markus Hill* spoke on behalf of FONDSBOUTIQUEN.DE with Dr. Patrick Adenauer, Managing Partner of the BAUWENS Group and German American Realty GmbH („GAR“), about the success factors for investments in US real estate. Topics such as market attractiveness, market outlook, and market segments were addressed. Factors such as interest rates, currency, equity, and mezzanine are also discussed.

Hill: Many institutional and semi-institutional investors are looking for investment opportunities in the real estate sector at home and abroad. Many of your clients also come from the family office sector. Why do you currently perceive an increased interest in US real estate investments?

Adenauer: There are several reasons for the increasing interest of German real estate investors in investments in the USA. On the one hand, positive geographic diversification effects can be achieved through real estate investments abroad. The foreign share of the real estate portfolios of family offices averages 10%, for institutional investors, it is often even lower. Geographical diversification is therefore a key motive and for German investors, there is still considerable potential for real estate investments abroad. On the other hand, real estate investors are looking for desirable returns. When entering the German real estate market, only low returns can be achieved given the current price level of existing apartments. Besides, the long-term outlook in Germany is characterized by an aging society and a less dynamic population development, in contrast to the USA.

Hill: In your opinion, what are the long-term advantages of the US economy?

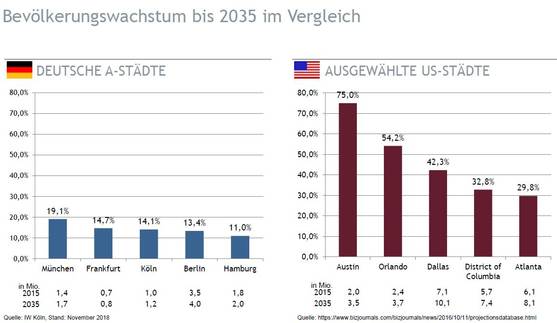

Adenauer: We have confidence in the American economic culture, which is characterized by sporting competition, professionalism, and transparency. Also, we value the American entrepreneurial spirit and thus we do not rely on the short-term, but rather on fundamental characteristics and long-term trends. With a 25% contribution to global GDP, the US is the world’s largest economy. Its economic dynamism is sustained and sustained over the long term by a population growth rate that is dynamic compared to Europe. The total population of the USA, currently 328 million, will increase to around 360 million by 2035. This corresponds to an annual growth rate of around 3 million inhabitants. The success of investments in residential real estate is largely dependent on the number of households and demanders. For this reason, we focus our purchasing activities on metropolitan regions with strong economic fundamentals and correspondingly positive population forecasts. In the USA there are around 50 metropolitan cities with over 1 million inhabitants. The population forecast for many of these cities is between 30% and 75% by 2035. For example, the population of the Dallas metropolitan area will rise from the current 7.1 million to over 10 million by 2035. For Germany, the IW Cologne forecasts that Munich will experience the strongest population growth of all German A-cities by 2035, amounting to 20%. By way of comparison: the economic power of the Dallas metropolitan region alone is roughly equivalent to the gross domestic product of Belgium. We are thus investing in individual economic areas within the USA. The USA has the world’s largest investable real estate market with high transparency, liquidity, and legal security.

Hill: Which type of property, which market segment, do you find attractive and valuable?

Adenauer: We are focused on the acquisition of multi-family houses (Multi-Family) and entire apartment complexes. About one-quarter of the US real estate market is in this investment segment. The demand for apartments, especially in metropolitan areas, is increasing and the trend towards renting instead of buying is still intact. For example, the homeownership rate has fallen from 69% to 63% over the past 10 years. Demand for rental apartments has risen accordingly – and this trend towards urban living is intact. For investors taking their first step into a foreign real estate market, investments in rental apartments offer the lowest level of risk. Housing is a basic need that is relatively independent of economic cycles, and our focus is on well-connected existing housing estates for middle-income groups. Ideally, these show a need for revitalization and repositioning. We leverage value enhancement potential through active letting management and continuous upgrading of the apartment complexes together with our joint venture partners. Even in an economic downturn, we consider this type of use to be safer than, for example, luxury residential or commercial properties. Also, the demand for residential space is largely resistant to the megatrend of digitalization and other disruptive changes.

Hill: Will the rise in long-term interest rates in the US perhaps lead to a cooling of the housing market?

Adenauer: A rise in long-term interest rates and the associated increase in the cost of borrowing should lead to an increase in initial yields or cap rates. However, we are convinced that the negative impact of a possible further rise in interest rates will be more than offset by the long-term positive fundamental data on the US residential real estate market. A further rise in interest rates is likely to cause the US economy to entice global capital flows, thereby increasing the value of the US dollar.

Hill: Aren’t the currency risks „incalculably“ high?

Adenauer: Investors investing with us have a very specific desire to be invested in US dollars, also to diversify assets across different currency areas. After all, the US dollar is the most important and fungible global currency. A foreign currency naturally entails exchange rate risks but also opportunities to the same extent. However, investors should only invest capital for US real estate investments that are not needed again in euros in the short term.

Hill: Your activities are primarily in the area of direct investments. Apart from this type of investment, are there other alternatives that allow institutional investors to participate in the growth of the US real estate market?

Adenauer: Yes, we see extremely interesting opportunities for this on the liabilities side via mezzanine loans. Our investments in existing residential properties are very well suited for the addition of real estate debt. The rental payment flows are granular and stable in light of the considerable demand. Meanwhile, the interest rate for senior loans in the USA is around 4.5%. It is therefore advisable to optimize the financing structure via mezzanine investments. Mezzanine tranches can generate returns of around 8-10% p.a. by investing in US portfolio apartments. It is also interesting that for investors subject to Solvency II, reduced capital requirements result. Loan receivables secured by real estate have to be backed by significantly less equity than direct investments.

Hill: In conclusion, do you see President Trump more as an obstacle or as an asset to the magnetism of the US real estate market?

Adenauer: So far, we have not seen any negative effects on the US real estate market as a result of this presidency. The tax reform benefits residents, businesses, and also German real estate investors.

Hill: Many thanks for the interview!

Dr. Patrick Adenauer has been the managing partner since 1989 of the BAUWENS group of companies, founded in 1873. He is also one of the managing partners of the German American Reality GmbH („GAR“). This company advises and accompanies entrepreneurial and operative real estate projects in the USA over the entire term. In addition to his professional obligations, Dr. Adenauer has held numerous offices in public life for many years, for example as President of FBN registered association (e.V. ) Germany, President of the association „Die Familienunternehmer – ASU e.V.“, Berlin (2005-2011), member of the Senate of the German National Foundation as well as various other positions as a member of the Supervisory and Advisory Boards, among others at Talanx Bancassurance Holding AG, TÜV Rheinland AG, and the DuMont Media Group.

One thought on “„The USA has the world’s largest investable real estate market with high transparency, liquidity and legal certainty“ (Interview – Dr. Patrick Adenauer)”