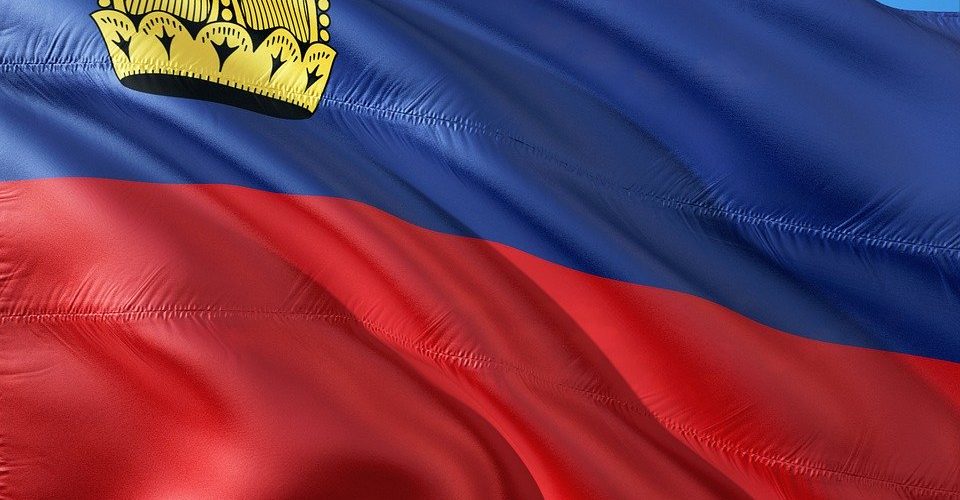

Liechtenstein is one of many attractive locations for the launch of funds in Europe. On behalf of FONDSBOUTIQUEN.DE, Markus Hill spoke to David Gamper, Managing Director of LAFV (Liechtenstein Investment Fund Association), about topics such as regulation, general conditions, special advantages of Liechtenstein as a location, as well as the role and importance of associations such as EFAMA (European Fund and Asset Management Association), IIFA (International Investment Fund Association) or BVI (BVI Bundesverband Investment und Asset Management e. V.) for the professional exchange of ideas. The associations in Germany, Luxembourg, Ireland, and Liechtenstein represent many common interests and maintain an intensive dialogue. In this context, the local cooperation of LAFV with local organizations such as the “Liechtenstein Finance” association and with the “Liechtenstein Marketing” agency also appears interesting, for example in the area of event activities in Germany for 2020 (events, webinars).

Hill: What topics does your association deal with?

Gamper: The design of the legal framework is an essential part of the association’s work. This is very extensive because, in addition to fund legislation, many other laws have a direct and indirect impact on the fund industry. On the one hand, the LAFV (Liechtenstein Investment Fund Association) intends to actively develop these laws further to continuously improve the attractiveness of the fund location, and on the other hand, it must deal with the European requirements. This includes monitoring at the European level concerning EU directives and regulations as well as the guidelines of the European Securities and Markets Authority ESMA. This keeps us up to date on what innovations are coming to the industry, what will have to be transposed into national law in the foreseeable future, and what is directly applicable. Our members are informed about all regulatory developments and those relevant to supervisory practice and, if desired, LAFV also organizes assistance in the form of workshops, training courses, working groups, model documents, etc. The flow of information between the industry and the legislator is also very important. The latter is confronted with so many different topics and needs additional technical expertise in various areas. For example, it consults specialists from the Financial Market Authority, who in turn consult with the fund industry, which is represented by LAFV in this respect. Also, there are regular discussions between the Liechtenstein Financial Market Authority and LAFV to continuously improve the framework conditions of the fund location. In addition to legal topics, the association also deals with tax issues, for example how funds can avoid double taxation based on tax treaties or EU law by reclaiming withholding taxes withheld for the fund investors.

Hill: Is there a special feature in the positioning of LAFV in contrast to associations of other fund locations?

Gamper: Unique in Europe is that the national association is the official publication organ for the fund industry. On the LAFV website, you will find the necessary information on all Liechtenstein funds that are subject to publication requirements. In the last four years, location marketing has also been developed, because just like Luxembourg and Ireland, Liechtenstein is a fund location from which cross-border business is conducted throughout Europe. However, the advantages of the fund domicile are still far too little known to potential fund initiators.

Hill: How does cooperation with other associations look like?

Gamper: LAFV regularly cooperates on a national level with other financial associations such as the Banking Association, the Association of Independent Asset Managers, or the Insurance Association. They coordinate their activities and advocate common interests in the regulatory area or the area of location marketing. At the international level, LAFV works primarily with other fund associations. The association is a member of EFAMA (European Fund and Asset Management Association), the European representation of interests of the fund industry, and IIFA (International Investment Fund Association). Almost all fund associations in the EEA and some third countries belong to EFAMA. The German fund association BVI, which I particularly appreciate, is also part of this pan-European organisation. This cooperation is in my view particularly important, especially for a small association like LAFV.

Hill: Your core task is the association work for the fund industry. How does cooperation with other “location marketing agencies” in Liechtenstein look like? How do you do networking, do you pass the ball?

Gamper: Correct, as already mentioned, marketing is only one of several sub-areas, and it has only gained in importance in the last 4 years.

But to get back to your question, to promote the financial center, the financial associations as well as other professional associations that express interest in the financial sector have founded the joint association Liechtenstein Finance. Although it has existed for some time, the association has only had its staff since the beginning of 2020. Of course, I am in active contact with Liechtenstein Finance. We exchange experiences, coordinate our appointments, and provide each other with professional input. Sometimes we also make use of the resources and expertise of Liechtenstein Marketing, which is responsible for tourism and business.

Hill: Concerning the fund industry – why can the Liechtenstein location be of particular interest to fund providers in contrast to competitors in the DACH region?

Gamper: Legally, the fund center offers a great deal of flexibility within the framework of the European requirements which Liechtenstein complies with due to its EEA membership. This can already be seen in the many different legal forms for funds, but it is expressed above all in many small points that often bring decisive advantages. A very important aspect is the open discussion of the Financial Market Authority. The most important tasks of financial market supervision are the supervisory and protective function, but it is also open to the needs of the market and always ready to talk to market participants and their concerns. This has a positive effect on the processes involved in setting up funds, but also in ongoing fund administration. For example, the processing of a license or a distribution notification usually takes less than five working days. Tax legislation is also attractive. The income tax rate for companies is 12.5 %. With the payment of this flat tax, everything is settled, because Liechtenstein knows neither capital nor coupon tax. There is also no distribution surcharge or taxes on dividends, as well as the capital and liquidation gains on participation. The customs union with Switzerland also has tax implications. The common VAT rate is 7.7 % and is by far the lowest rate in the European Economic Area (EEA). In turn, funds are effectively tax-exempt in Liechtenstein. There are neither income taxes nor a subscription tax.

Hill: Corona times promote the digitalization trend. Are events planned, be they webinars or face-to-face events? Which formats are available here?

Gamper: In Germany, we have three formats with a physical presence. The LAFV organises annual events on fund topics in Düsseldorf and Munich. Within the framework of the financial center event of Liechtenstein Finance in Frankfurt, we hold a fund workshop, and besides, we hold round-table discussions together with other Liechtenstein financial associations in various cities. Unfortunately, due to COVID-19, all events for the year 2020 have had to be cancelled so far. Since we consider direct contact to be more efficient, we have not switched to webinars. We hope that next year we can be active again as usual. However, if COVID-19 should keep us busy for a longer time, we will certainly have to think about alternatives, such as webinars.

Hill: Many thanks for the interview.

Fund Boutiques & Private Label Fonds (Liechtenstein):

Liechtenstein Investment Fund Association (LAFV)

Associations (Europe / Germany):

EFAMA (European Fund and Asset Management Association)

IIFA (International Investment Fund Association)

BVI (BVI Bundesverband Investment und Asset Management e. V.)

Photo: www.pixabay.com

4 thoughts on “FUND BOUTIQUES & PRIVATE LABEL FUNDS: Liechtenstein, asset management, associations and the cultivated exchange of ideas (Interview – David Gamper, LAFV Liechtensteinischer Anlagefondsverband)”