“Knowledge speaks, but wisdom listens.” (Jimi Hendrix) A few years ago, I was able to experience the forests of Norway with colleagues in a kind of “survival” mode – including campfire romance, building river bridges together, setting up camp for the night without a tent, as well as unaccompanied marches […]

Article

Sustainable investments, ESG criteria, climate change, and ratings – many private and institutional investors focus on these topics. Markus Hill spoke with Roland Kölsch, Qualitätssicherungsgesellschaft Nachhaltiger Geldanlagen (QNG), about this range of topics and the special features and challenges of the rating process for CAT bonds (insurance-linked securities). The conversation […]

Caduff: Mr. Hill, you are a first-class expert on the family office landscape in Germany. It’s not for nothing that you’re called “Mr. Family Office. Are you coming through the crisis well in business terms? Hill: Family offices, like the classic Mittelstand and fund boutiques, are known to be “long-term […]

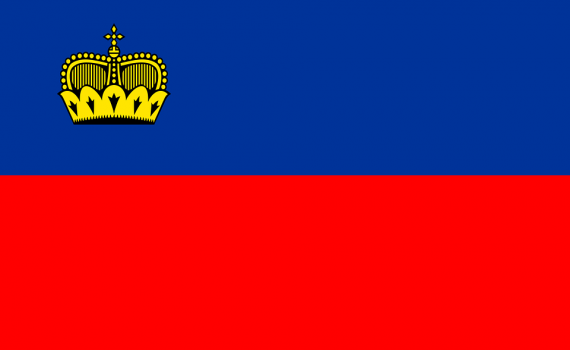

Each fund location has its special strengths, diversity invigorates the business. Markus Hill spoke for FUNDBOUTIQUES.COM with David Gamper, Managing Director of the LAFV Liechtenstein Investment Fund Association, about topics such as fund launch, real estate, blockchain, AIFM, family offices, and innovation clubs. Besides, the special, cooperation-oriented constellation of the […]

In December last year, a panel discussion on ESG and Insurance-Linked Securities (CAT Bonds) took place on the industry platform ARTEMIS. Markus Hill spoke for FUNDBOUTIQUES.COM with Nico Rischmann, Plenum Investments AG, about the challenges in this market segment, investor education, and the need for cooperation in the industry (sponsors […]

Topics such as ESG, climate change, and the current investment needs of institutional investors are intensively discussed. Markus Hill spoke for FUNDBOUTIQUES.COM with Daniel Grieger, Plenum Investments AG, about the challenges for portfolio management in the fixed income segment, the topic CAT Bonds (Insurance-Linked Securities), and about his enthusiasm for this […]